Intelligent Family office General Ledger

The general ledger built

for your family office

Command, expand, and elevate family office decision-making.

Powered by a single, powerful general ledger.

Switch from generic accounting to a platform designed for clarity.

Asseta's multi-entity, multi-class general ledger is designed to scale infinitely, perfectly tailored for your family office.

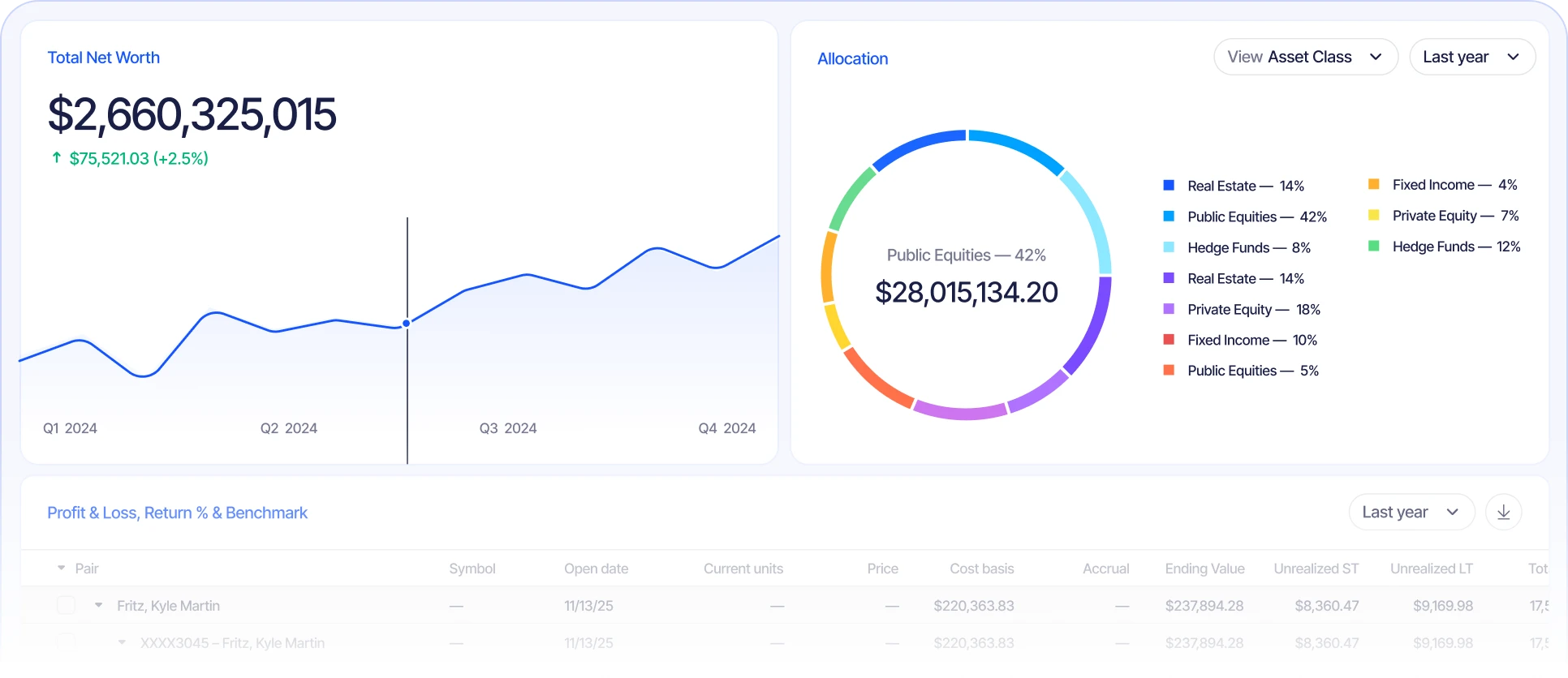

Visibility

All your accounting and finance data in one place.

Automation

Built with cutting-edge ledger technology to help you scale.

Data Governance

Easily integrate all your financial data with Asseta's API.

Multi-entity

Modular enough to meet your business needs.

Multi-dimensional

Easily integrate all your financial data with Asseta's API.

Here’s what you can get done

with Asseta AI in just 90 days.

See a demoToday

Get started

- Create your Chart of Accounts

- Setup all your entities

- Import historical data

Day 45

Get comfortable

- Link up all your bank accounts and brokerages

- Set up user permissions

- Gain access to dozens of pre-built reports and dashboard widgets

Day 90

Ask why you didn’t switch last year

- 100% of reporting moved to Asseta

- Reconcile accounts 8.5x more efficiently

- Books close 85% faster

The premier family office suite.

Built to save you time and money.

Asseta adapts to your rhythm, automating mundane financial tasks and turbocharging family office monthly close.

Automation

Eliminate busywork with advanced automation and AI that learns from you

Asseta adapts to your rhythm, automating mundane financial tasks and turbocharging family office monthly close.

API

See a unified view of your family office financials with Asseta's API

Create accounting connections and securely sync all transaction data with your applications.

Check all integrationsTransact

Navigate global commerce with an infinitely scalable and integrated family office general ledger

Effortlessly handle currency translation and transact in 180+ currencies.

Speed

Close out your books in hours rather than days through a repeatable close process

Close your books faster and more efficiently

with our collaborative close process.

Don't just take our word for it.

Integrate your family office data and achieve complete visibility

Secure, AI-powered tools build to give you clarity, control and a single source of truth.

Investments

Addepar

Addepar empowers investment

professionals across the globe with data, insights and cutting-edge technology.

Investments

Arch

Arch solves many of the problems facing active Investors / LPs: collecting K-1s; logging into the various web portals; and tracking performance, cash flows, and metrics across their investments.

Investments

MyFO

MyFO delivers the most advanced family office experience, seamlessly combining efficiency with secure, centralized tools to transform wealth management.

Investments

Charles Schwab

Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more.

Investments

Coinbase

Coinbase is a secure online platform forbuying, selling, transferring, and storing cryptocurrency.

Investments

Asora

Asora is a SaaS solution for single and multi-family offices to track and oversee assets, automating data capture and providing digital on-demand reporting on the web and mobile.

Browse our family office resources

Choose topics or categories you are interested in to see relevant content.

.png)

Letter from our CEO

Reflections on 2025 and Ambitions for 2026

.png)

Asseta AI Raises $4.2 Million to Define the Next Era of Family Office Infrastructure

Announcing our series seed funding co-led by Nyca Partners and Motive Partners.

Everything you need to know, all in one place

Can Asseta replace QuickBooks for my family office?

Yes. Asseta is a purpose built family office general ledger platform designed to unify investments and accounting.

Asseta is built to replace QuickBooks for family offices that have outgrown single-entity accounting. Unlike QuickBooks, which was designed for small businesses, Asseta is a purpose-built general ledger and investment platform that handles the complexity of multi-entity, multi-currency family office operations.

With Asseta, you can:

- Integrate banking, investments, and accounting into one platform

- Consolidate across dozens of entities in real time

- Eliminate manual spreadsheets and workarounds

- Gain audit-ready books with family office–specific reporting

Is Asseta a general ledger?

Yes.

A general ledger forms the basis of a company's accounting system. It documents all company transactions, such as assets, liabilities, equity, revenues, and expenses. Every entry includes a debit and a credit, which must always balance to maintain accurate financial records.

The general ledger plays an integral role in producing financial statements. It helps businesses track their financial performance over time, allowing them to identify trends, manage budgets, and make informed financial decisions. The general ledger also assists in ensuring compliance with financial regulations and standards, as it provides a complete and accurate record of all financial transactions carried out by the company.

What is the advantage of choosing Asseta?

Asseta is the only intelligent family office suite purpose-built to unify accounting, banking, and investments in one platform. Unlike generic software, Asseta is designed around the unique complexity of multi-entity, multi-asset family offices.

With Asseta, you gain:

- A modern general ledger built for family office scale

- Seamless integration across your existing systems

- Real-time visibility and reporting across every entity

- A platform that evolves quickly with the needs of the industry

By choosing Asseta, you’re equipping your family office with clarity, control, and a partner focused exclusively on your success.

Does Asseta automate inter-company activity?

Asseta handles inter-company activity by automating transactions between entities within the same organization. Our platform simplifies these processes by providing tools to reconcile inter-company accounts automatically, ensuring accuracy and compliance.

How long does it take to implement Asseta?

Our average customer goes live within 8-12 weeks. The timeline depends on the state of your data, technology needs, and resource capacity. Asseta's team of CPAs, engineers, and customer success personnel will work directly with you to ensure an efficient implementation.

Is Asseta suitable for single-family and multi-family offices?

Yes. Asseta is purpose-built for both single-family offices and multi-family offices managing complex portfolios and multiple legal entities.

For single-family offices, Asseta provides a modern general ledger and investment platform that eliminates spreadsheets, consolidates entities, and delivers real-time visibility across all assets and accounts.

For multi-family offices, Asseta scales seamlessly to support multiple client structures, intercompany accounting, and consolidated reporting all while maintaining the security, permissioning, and transparency required to serve multiple families.

Whether you oversee one family’s wealth or operate as a professional multi-family office, Asseta equips you with the clarity, control, and efficiency to manage accounting, investments, and operations in one unified platform.

Can I import historical data?

Most family offices go live on Asseta within 8–12 weeks. The exact timeline depends on the state of your data, technology environment, and available resources.

From day one, Asseta’s team of CPAs, engineers, and customer success experts work alongside you ensuring a smooth migration, tailored configuration, and efficient onboarding so your team can realize value quickly.

Is customer support included?

Yes, all customers receive dedicated support. Our team is available via Slack, email, and scheduled calls to assist with questions, troubleshooting, or ongoing guidance.

Response times are under 1-hour and we aim to get you the help you need as soon as possible.

Do you support multi-dimensional accounting (e.g. by fund, family member, asset class)?

Yes. Asseta natively supports multi-dimensional accounting, giving you the flexibility to track and report on transactions across any dimension that matters to your family office.

You can tag transactions and balances by fund, entity, family member, asset class, investment vehicle, project, or custom dimension. This enables you to slice data in multiple ways, run consolidated or granular reports, and drill down for deeper insights all without manual spreadsheets.

With Asseta, your accounting reflects the true complexity of your portfolios, making analysis, reporting, and decision-making faster and more accurate.

.svg)

.png)