For families of significant means, managing wealth can become more complex than creating it. This article explains who needs a Family Office and why it might be easier than you think. Family offices have traditionally been the domain of the ultra-wealthy, their appeal has broadened due to the financial, operational, and personal advantages they offer.

In a previous article, we laid out How to setup a Family Office; now we are going to break down who needs a family office, why they may need one and the differences between a Single Family Office (SFO) and Multi-Family Offices (MFO).

Who Needs a Family Office?

A family office is typically designed for individuals or families with substantial wealth who seek a comprehensive and centralized approach to managing their financial affairs.

Family offices are particularly valuable to those with complex asset portfolios, multiple income streams, or family-owned businesses. They cater to families with significant wealth to meet not only financial needs but also administrative, legal, philanthropic, and lifestyle management.

In general, those who benefit from a Family Office structure would be:

- High-Net-Worth Individuals (HNWIs): With investable assets of $5 million or more, HNWIs may benefit from some type of family office services.

- Ultra-High-Net-Worth Individuals (UHNWIs): Families with investable assets of $50 million or more are typically the primary clients of family offices.

- Multi-generational Families: Families aiming to create multi-generational wealth, who need continuity in financial management and succession planning.

- Those who experienced a recent liquidity event: Let's say you recently sold your company for 8-9+ figures, now what do you do with your money?

How Much Money Do You Need to Start a Family Office?

Establishing a family office involves significant financial commitments, particularly in a single-family office structure, where the family bears the full operational cost. While exact figures can vary based on location, scope, and desired services, here’s a general breakdown:

- Single-Family Office (SFO): Creating a single-family office typically requires a minimum of $50 million to $250 million in investable assets. This range ensures that the family can cover the setup and ongoing costs, which may range from $1 million to $10 million annually, or about $3.2 million (JP Morgan 2024 Family Office Report). Higher operating costs arise from hiring qualified staff, implementing technology, regulatory compliance, and providing in-depth advisory services.

- Multi-Family Office (MFO): A multi-family office structure allows multiple families to share resources, thereby reducing individual costs. MFOs may have lower entry requirements, with some accepting families with $20 million to $50 million in investable assets. These offices can spread the cost of personnel, technology, and other expenses across clients, making them more accessible to families with less extensive wealth than an SFO would require.

Beyond the balance sheet, the ultimate value of a family office lies in its ability to serve as a centralized command center for navigating the intricate complexities of modern wealth.

In an era defined by global market volatility, digital asset complexities, and sophisticated cybersecurity threats, a family office provides a crucial framework for proactive risk management and strategic foresight.

It moves beyond traditional wealth management to establish robust family governance, creating a formal structure for decision-making, conflict resolution, and the education of future generations.

This strategic integration of financial oversight with legacy preservation ensures that a family's core values are not only protected but also woven into the fabric of their philanthropic and investment endeavors, securing a lasting and meaningful impact for generations to come.

What is a Single-Family Office (SFO)?

A Single-Family Office (SFO) is an entity exclusively dedicated to managing the wealth and affairs of one family. It typically has a dedicated team of financial advisors, accountants, attorneys, and support staff working solely for that family that invest their assets across a broad range of classes including collectibles, real estate, private equity, direct and venture investments and fund of funds. SFOs offer unparalleled personalization and privacy, as they are not beholden to the needs of multiple clients.

Key features of a Single-Family Office include:

- Customized Services: The SFO can provide highly tailored financial, lifestyle, and administrative services.

- Direct Control and Influence: The family retains complete control over investment decisions, ensuring that the family’s specific needs and values are prioritized.

- High Operating Costs: An SFO demands a substantial financial commitment for staffing, technology, and operations, with annual expenses often reaching several million dollars.

Due to the high costs and exclusivity, SFOs are generally only feasible for families with substantial wealth, often exceeding $50 million to $250 million in investable assets. Family offices are starting further down market. With recent stock market booms and a strong economy, many wealth individuals are wanting to professionalize their operations with multi-entity accounting software.

What is a Multi-Family Office (MFO)?

A Multi-Family Office (MFO) provides family office services to multiple families, allowing them to share resources and costs. By pooling client families, an MFO can deliver many of the same services as an SFO, but at a reduced cost, making it accessible to families with lower investable asset thresholds.

Advantages of a Multi-Family Office include:

- Cost Efficiency: Shared costs make MFOs a more economical choice, often requiring as little as $20 million to $50 million in investable assets.

- Professional Management: MFOs are typically staffed by highly qualified professionals who serve the needs of multiple clients, providing access to sophisticated investment and planning expertise.

- Broader Range of Services: Although services may not be as customized as in an SFO, MFOs offer a robust suite of financial, tax, and estate planning services that meet the needs of most high-net-worth families.

While MFOs offer less control than an SFO, they remain a popular choice for families seeking professional management and privacy without the high costs of establishing an exclusive office.

Why You Need a Family Office

The reasons for establishing a family office extend beyond simple wealth management. A family office provides a broad range of benefits:

- Centralized Financial Management: Family offices streamline financial processes, from investment management to tax planning, ensuring a cohesive and strategic approach to wealth. They also can streamline their chart of accounts to ensure accuracy and standardization of capital flows.

- Privacy and Confidentiality: High-net-worth families often prioritize privacy. A family office offers a discreet platform to handle sensitive financial matters without third-party interference. Selecting secure platforms ensures complete privacy and control.

- Generational Wealth Planning: A family office facilitates succession planning and ensures that wealth is passed efficiently across generations, incorporating education, guidance, and governance structures.

- Philanthropy and Legacy: Many family offices manage philanthropic endeavors, ensuring that family values and social commitments are met in a structured and impactful way.

- Tailored Services: Family offices offer a bespoke suite of services that cater to personal lifestyle needs, which can include managing properties, specialized technologies like ERP, private travel arrangements, or specialized healthcare.

- Beyond financial matters, a family office can act as a personal concierge, managing everything from acquiring real estate and hiring household staff to handling private travel logistics and ensuring personal security. This might include performing due diligence on aircraft purchases, managing art or wine collections, or even handling school admissions for the next generation, freeing up the family's time to focus on their passions.

Establishing a family office requires a substantial level of wealth, but it offers unmatched benefits for high-net-worth individuals and their families. Single-family offices suit families with extensive resources and complex needs, while multi-family offices make family office services more accessible to those with smaller, yet still significant, asset bases. By understanding the structure and requirements of each type, families can make informed decisions to achieve their financial and legacy goals.

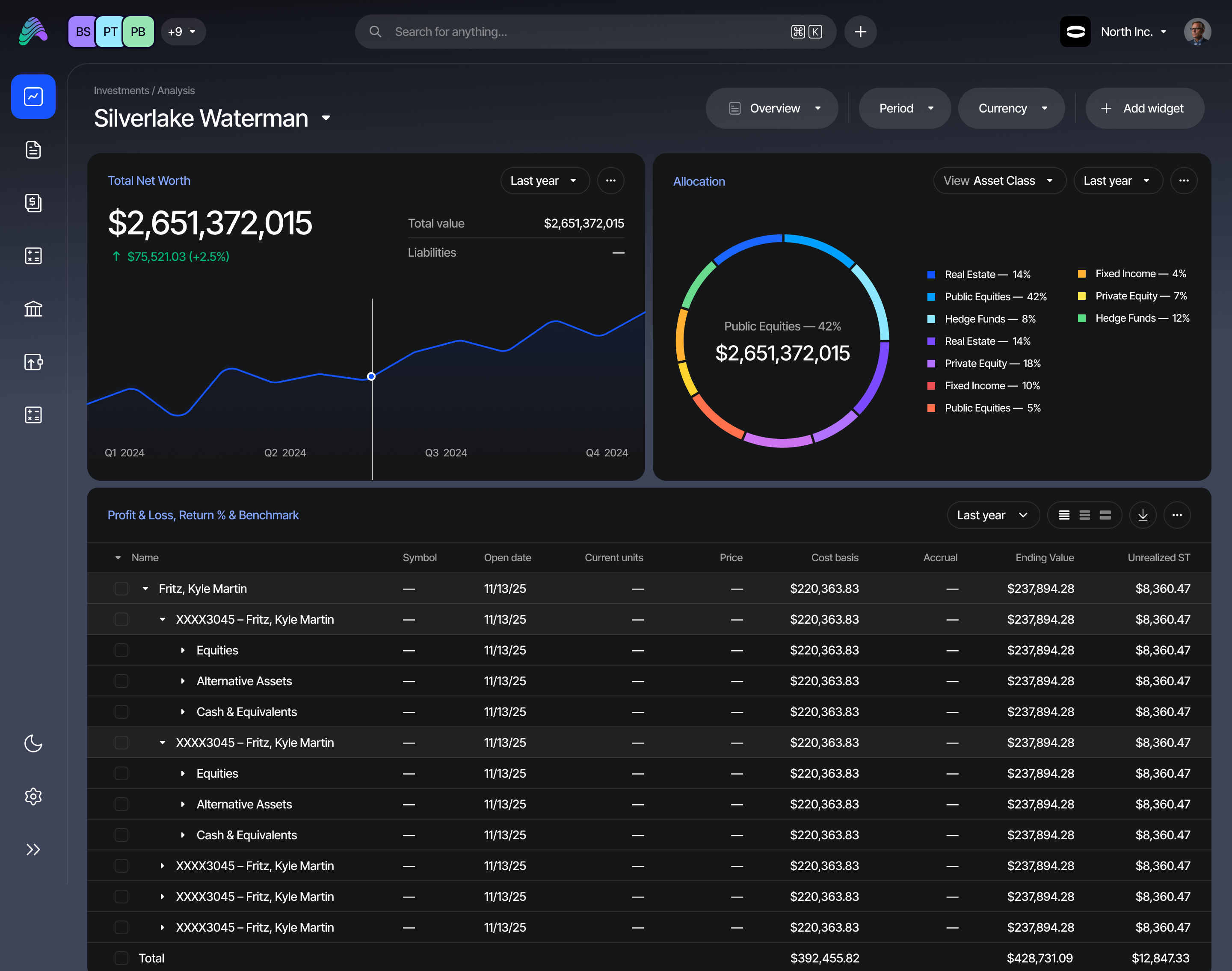

The modern family office runs on a sophisticated technology stack designed for security, transparency, and efficiency. This goes beyond basic accounting software to include aggregated reporting platforms like Asseta AI, Addepar or Masttro that provide a consolidated view of all assets, from public equities to illiquid private investments. Furthermore, robust cybersecurity solutions are paramount for protecting sensitive data, while secure communication portals and document management systems streamline collaboration among family members and advisors, creating a single source of truth for all financial and administrative matters.

Deciding on the right family office structure is a critical step in securing your family's future. We at Asseta AI believe running your family office requires a blend of expertise, knowledge and innovative family office specific software. If you are exploring a tailored solution, reach out to our team today.

.svg)

.png)

%20(1).png)

.png)

.png)

.png)