Single Family Offices: The Control Model for Serious Wealth

A single family office (SFO) provides a tightly controlled structure for families with substantial capital and complex needs. Unlike models that split attention across unrelated households or rely on third-party platforms, the SFO centralizes every decision, relationship, and data point under the family’s control.

What is a Single Family Office used for?

An Single Family Office (SFO) is a private organization created by one family to manage its wealth, legal matters, investments, administration, and generational planning. It operates with one mandate: prioritize the long-term goals of a single family. This level of control creates a closed ecosystem where governance, confidentiality, and decision-making move without compromise or competition.

Structural Priorities

Family Oversight

The family serves as both beneficiary and board. Its directives shape investment strategy, succession, philanthropy, and every policy governing the office.

Internal Team

Most SFOs build teams across three primary functions:

- Investments: Portfolio managers, CIOs, asset allocators

- Finance and Legal: CFOs, estate planners, tax attorneys

- Administrative Support: Property managers, private staff, family advisors

Technology Stack

A dedicated tech layer enables real-time visibility, reporting, compliance tracking, and information security. The SFO’s infrastructure is built to serve the family’s scale, not a marketplace.

Why Families Build SFOs

The structure of an SFO enables full customization without outside friction. Investment approaches can shift quickly. Legacy plans can reflect the family’s intent, not institutional limits. Sensitive matters stay private because data does not travel across unrelated entities. The entire infrastructure exists for one household—its assets, trusts, entities, and people.

Operational Focus Areas

Governance

The most effective offices document policies around decision-making, succession, and dispute resolution. Governance is proactive, not reactive.

Investment Oversight

SFOs typically implement wide diversification across asset classes with a direct lens on family risk tolerance, liquidity, and opportunity sourcing. Regular reviews drive precision, not reaction.

Legal and Tax Strategy

With in-house or dedicated external counsel, these offices optimize entity structures, oversee regulatory compliance, and design generational transfer mechanisms.

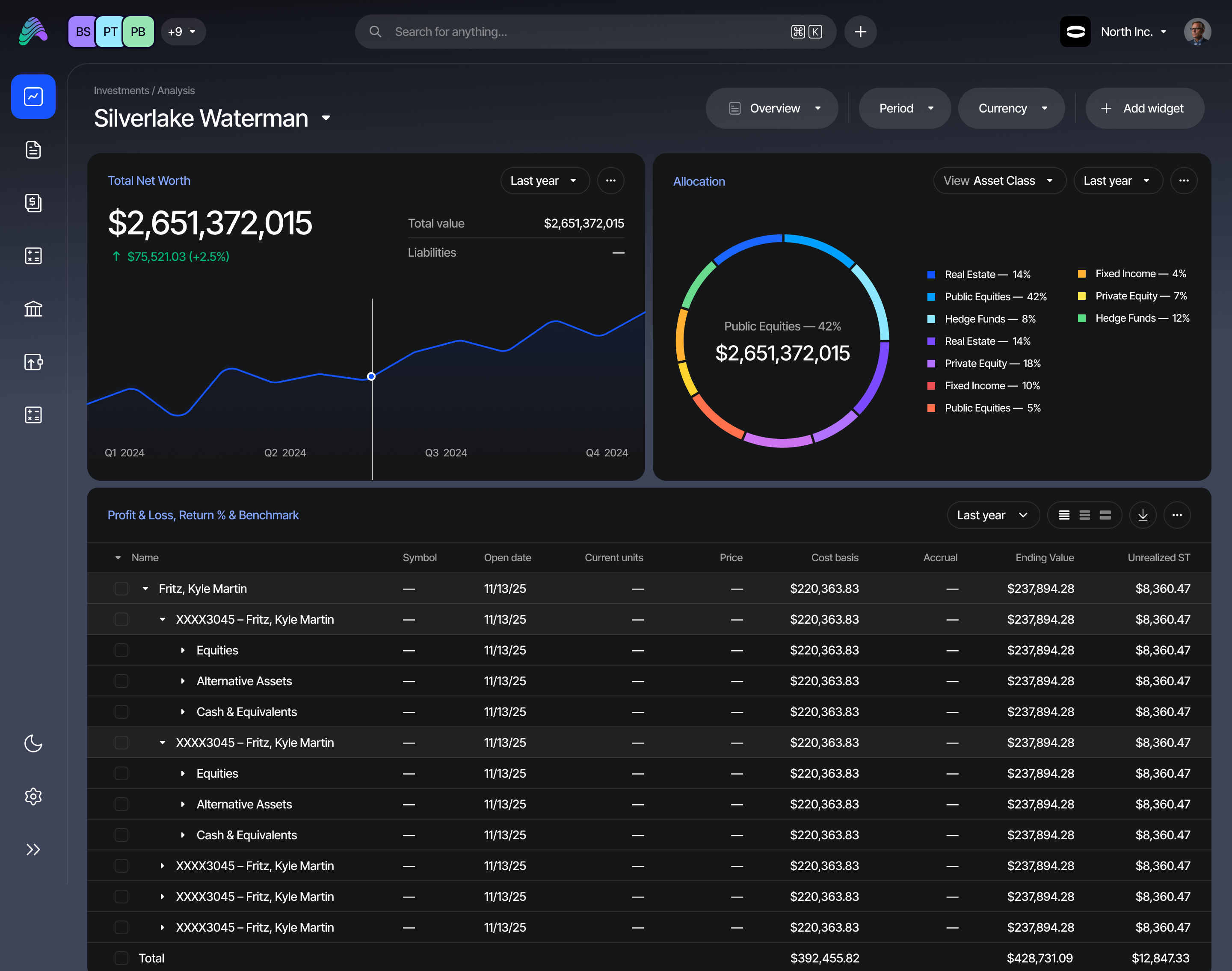

Technology and Systems

The best offices operate on unified platforms for performance monitoring, risk control, financial reporting, and secure access. Solutions like Asora Technologies cater specifically to these needs.

Threshold for Implementation

Most families consider establishing an SFO when wealth surpasses $100 million and spans across multiple asset types or legal entities. Families with extensive business holdings, philanthropic interests, or multigenerational involvement gain measurable benefits from building their own structure. These offices require ongoing capital and strategic intent but return autonomy and agility in exchange.

Building a Single Family Office

- Define Objectives: Set policy across investment philosophy, family governance, and continuity.

- Recruit Core Staff: Prioritize experience in asset management, estate planning, tax optimization, and administration.

- Establish Infrastructure: Select systems for investment control, reporting, and communication.

- Formalize Structure: Create legal entities, internal charters, and compliance documentation.

- Review Regularly: Conduct performance and satisfaction reviews across teams, processes, and results.

Comparison with Other Models

Multi-Family Offices

These are efficient for smaller portfolios, but shared services restrict depth and individualization.

Outsourced Private Offices

These offer service without structure. Families sacrifice integration and clarity in exchange for lower setup burdens.

Virtual Models

Useful for tech-savvy or mobile families, but often limited in scope, especially in concierge or generational planning.

Final Perspective

A single family office is not an accessory or a status signal. It is a deliberate structure built for control, precision, and generational continuity. Families that require these outcomes build them. Others inherit what institutions offer.

.svg)

.png)

%20(1).png)

.png)

.png)